I. The Triple-Layered Tariff Structure: A 104%-206.5% Cost Barrier

1.1 Cumulative Tariff Effects

Effective April 14, 2025, U.S. tariffs on Chinese lithium batteries now combine multiple policy instruments:

EV Batteries: 3.4% base rate + 20% fentanyl-related levy + 25% Section 301 tariff + 84% reciprocal duty= 132.4% total

ESS Batteries: Partial Section 301 exemptions until 2026, current rate at 114.9%

Vehicle-Integrated Batteries: 206.5% when imported as complete vehicles (2.5% base + 100% Section 301 + 20% fentanyl + 84% reciprocal)

Cost Case Study: Chinese ESS cells priced at 0.038/Whface82.40.038/Whface82.40.124/Wh—erasing price competitiveness against domestic alternatives.

II. China’s Lithium Battery Dominance: Four Pillars of Global Leadership

2.1 Vertical Integration Ecosystem

Controls 60% global lithium processing, 75% cathode material output, and 85% battery equipment supply

Refining cost advantage: 30-40% lower than Western counterparts

2.2 Patent & Production Supremacy

Holds 63% of global lithium battery patents (2024 data)

CATL’s CTP 3.0 achieves 72% volumetric efficiency with 13% energy density improvement

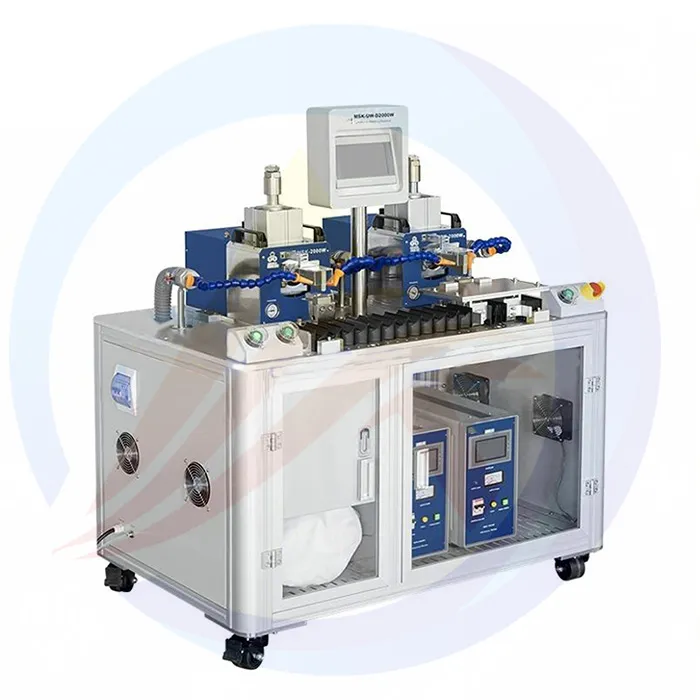

2.3 Intelligent Manufacturing Solutions

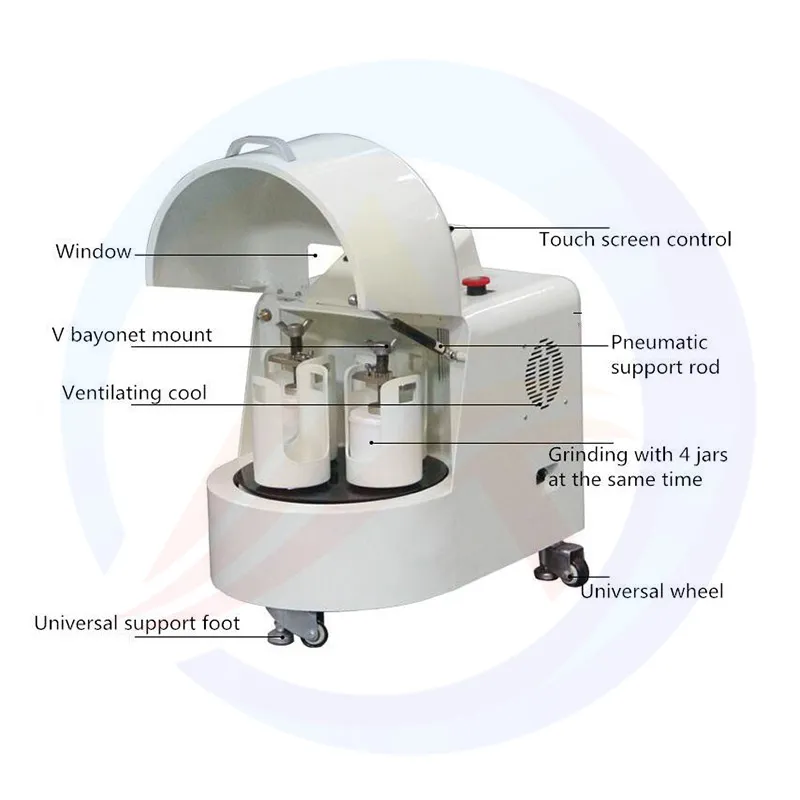

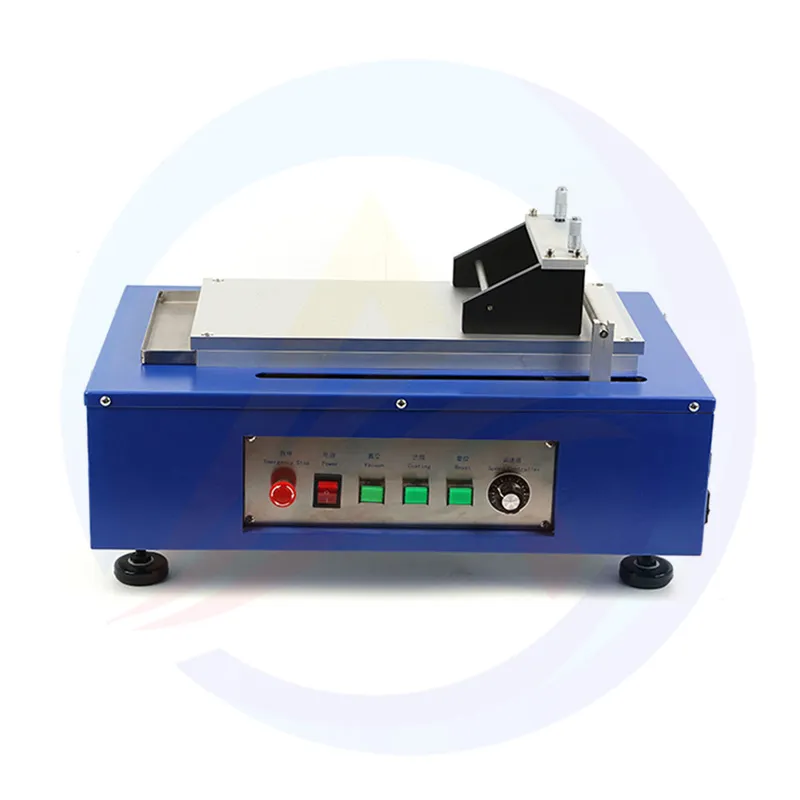

Full-process equipment integration: ±1μm coating precision to 95%+ automated module assembly

AI-powered quality control: 99.98% defect detection accuracy

2.4 Domestic Market Resilience

78% global battery output share (1,214.6GWh in 2024)

12M+ NEV sales projected in 2025, absorbing production capacity

III. Why Global Manufacturers Choose Our Battery Equipment Solutions?

3.1 End-to-End Production Line Expertise

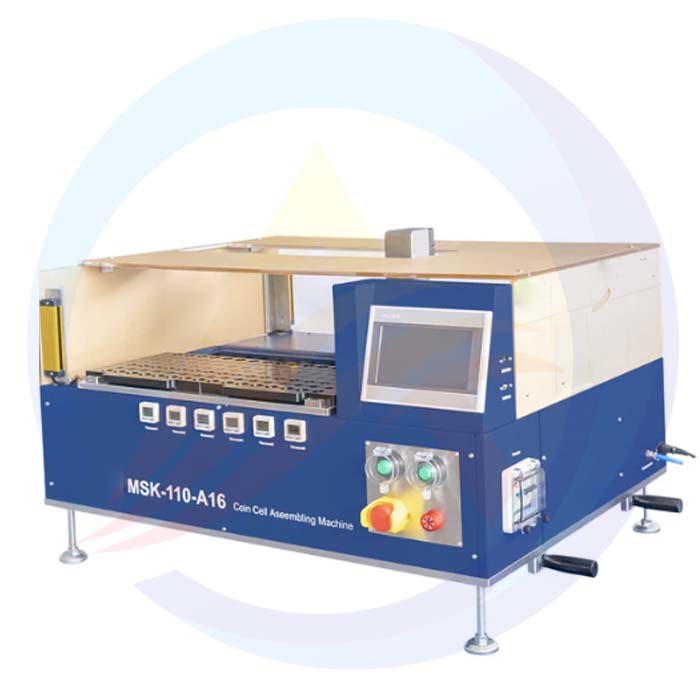

Modular Design: Rapid configuration switching (<72hrs) between LFP/NMC/solid-state battery lines

Energy Efficiency: 35% reduced drying energy consumption with ≥88% OEE

3.2 Precision Engineering Breakthroughs

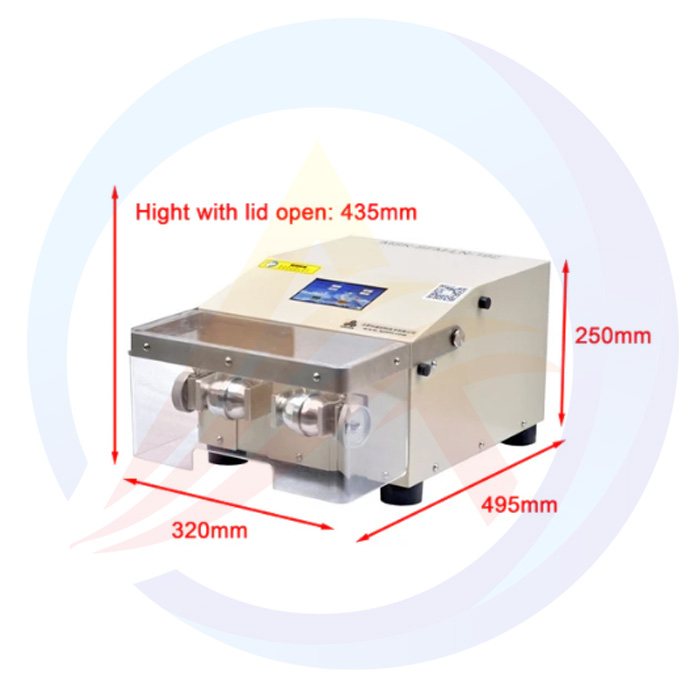

Electrode Manufacturing: Multi-stage tension control eliminates coating wrinkles (99.5%+ yield rate)

Assembly Accuracy: ±0.01mm laser welding precision for 4680 cylindrical cell production

IV. Tariff Navigation Strategies: Building Future-Ready Supply Chains

4.1 Regional Manufacturing Hubs

ASEAN Advantage: 24% effective tariff rate in Malaysia vs 132.4% direct U.S. import

EU Localization: Leverage CBAM carbon regulations with our energy-efficient equipment

4.2 Next-Gen Technology Adoption

Sodium-Ion Transition: Our pilot lines enable 15% cost reduction by 2027

Solid-State Preparation: Co-development programs with 20% faster prototyping

Turning Trade Barriers into Competitive Advantages

While 2025 U.S. tariffs disrupt traditional export models, they accelerate three irreversible trends:

Technology-Driven Cost Leadership: Chinese equipment enables 22% lower OPEX than Western counterparts

Glocalization 2.0: Our hybrid model combines Chinese engineering with regional compliance

Future-Proof Innovation: Sodium/solid-state transition pathways built into current systems

By partnering with us, manufacturers gain not just machinery, but a strategic ally in navigating the new era of lithium battery globalization.